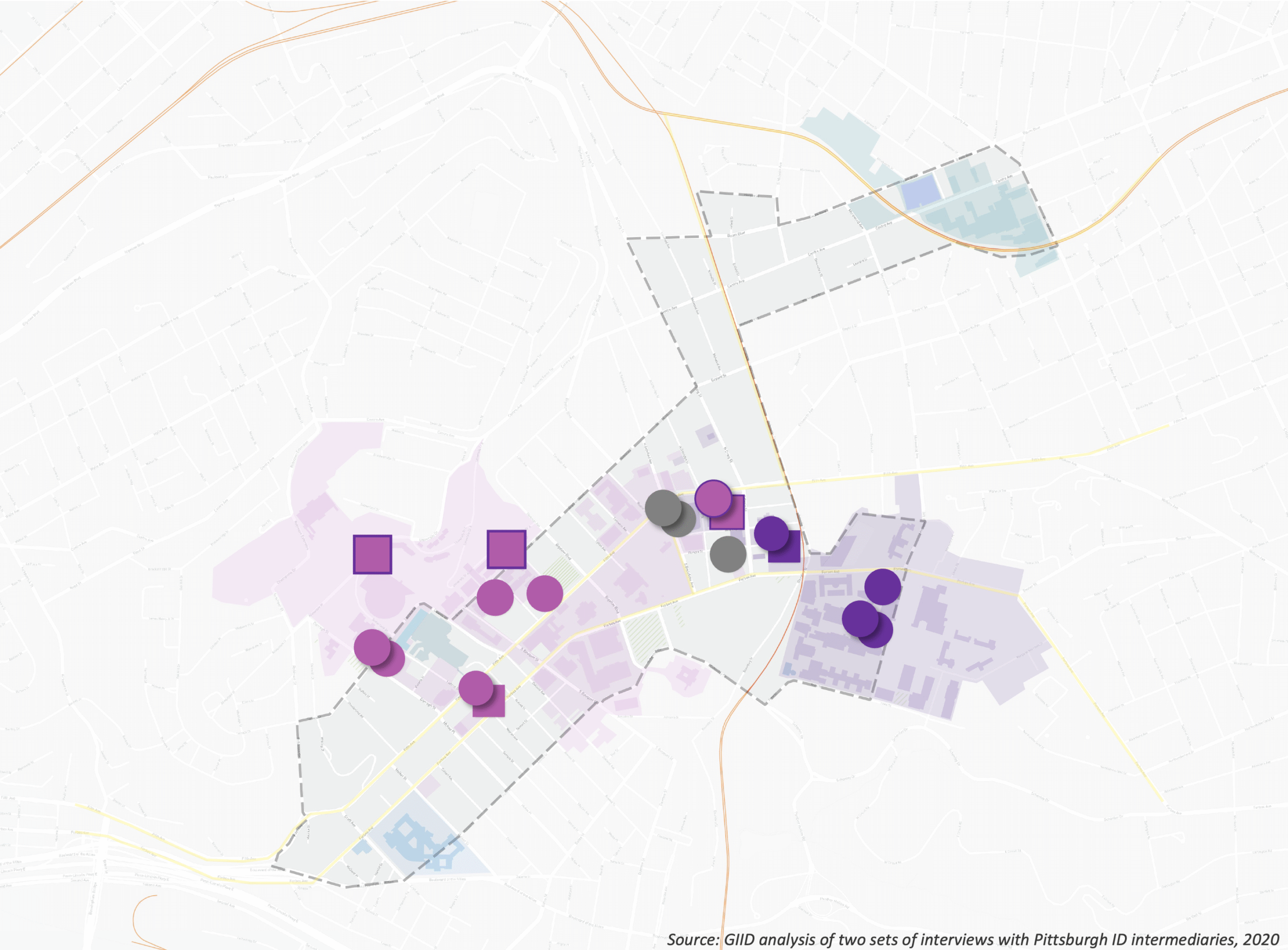

Anchor institutions: universities and medical institutions

Learn / Who shapes districts / Investors / Capital Investors

Capital investors

Asset-rich companies, civic entities, and financial institutions invest in districts at various stages of development

The role of capital investors

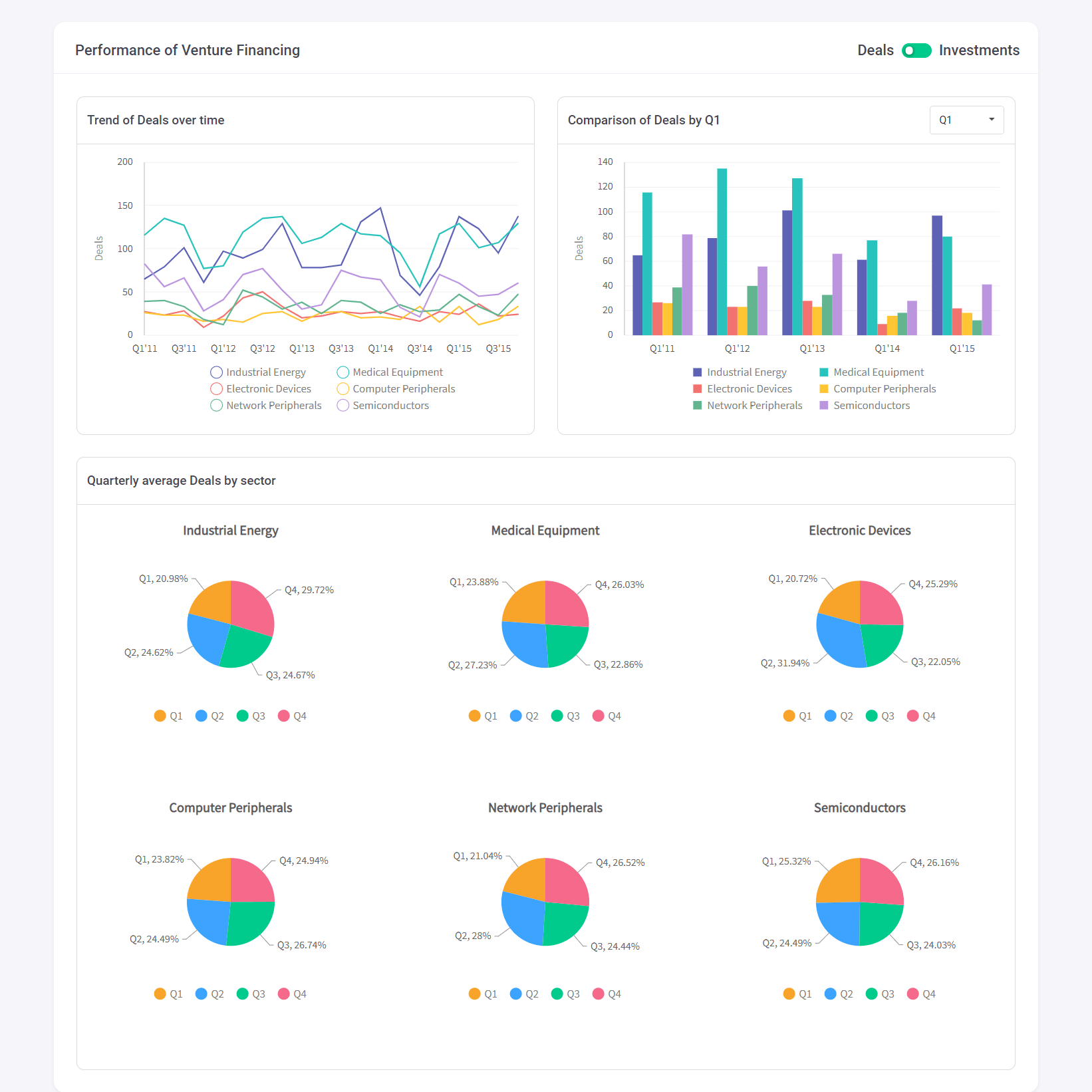

Capital is necessary to fuel district growth and expansion. Financing in many forms and from a variety of sources is needed to support basic science and applied research; the commercialization of innovation; entrepreneurial start-ups and expansion (including business incubators and accelerators); urban residential, industrial, and commercial real estate (including new collaborative spaces); place-based infrastructure (e.g., energy, utilities, broadband, and transportation); education and training facilities; and intermediaries to steward the innovation ecosystem. Resources are also needed to support programmatic activity within districts which activate the physical spaces.

The funding of these types of assets and uses can occur over several decades and is generally financed by a range of investors. Some of the most common investors found in districts include:

Real estate: developers and REITs

Institutional investors: Pension funds and insurance

Private equity and venture capital

Philanthropy and impact investors

Companies

Governments

Innovation districts must make a compelling case for investment and even create special investment vehicles tailored to disparate kinds of activities.

Who shapes districts

Ecosystem builders

A diversity of intermediaries, accelerators and incubators, and new kinds of anchors.

Learn more

Mission-driven organizations

Learn more